All Categories

Featured

Table of Contents

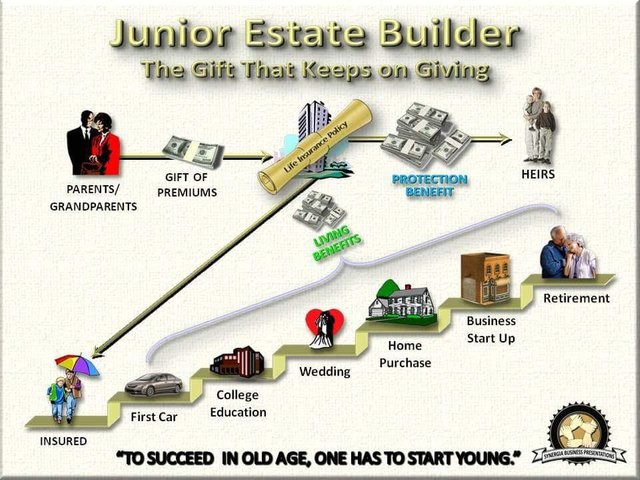

The are whole life insurance policy and global life insurance policy. expands cash money worth at a guaranteed rate of interest rate and also with non-guaranteed rewards. expands cash money worth at a dealt with or variable rate, depending upon the insurance provider and plan terms. The money value is not included to the survivor benefit. Cash worth is a feature you capitalize on while to life.

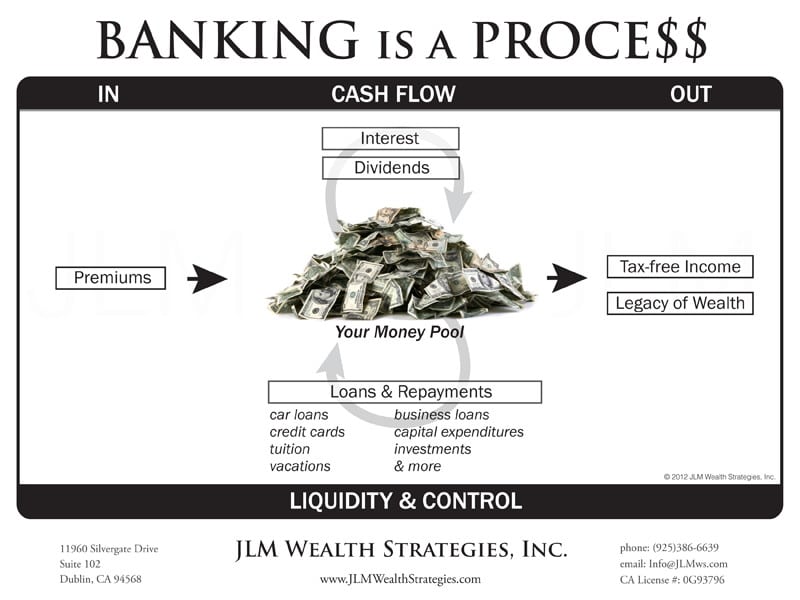

After ten years, the cash money value has actually grown to approximately $150,000. He obtains a tax-free finance of $50,000 to start an organization with his bro. The plan lending rate of interest price is 6%. He pays back the car loan over the following 5 years. Going this path, the passion he pays goes back right into his plan's money value as opposed to a banks.

Bioshock Infinite Comstock Bank Cipher

The idea of Infinite Banking was created by Nelson Nash in the 1980s. Nash was a financing specialist and fan of the Austrian school of economics, which advocates that the worth of items aren't explicitly the result of traditional economic frameworks like supply and demand. Instead, people value cash and products in a different way based on their financial condition and requirements.

Among the pitfalls of typical financial, according to Nash, was high-interest rates on lendings. Way too many people, himself included, entered into monetary difficulty because of dependence on banking establishments. Long as banks set the interest prices and financing terms, individuals really did not have control over their very own wealth. Becoming your own banker, Nash established, would place you in control over your monetary future.

Infinite Financial requires you to own your monetary future. For goal-oriented people, it can be the finest economic tool ever. Right here are the benefits of Infinite Banking: Perhaps the solitary most advantageous facet of Infinite Banking is that it enhances your money flow.

Dividend-paying entire life insurance policy is extremely reduced risk and uses you, the insurance policy holder, a lot of control. The control that Infinite Banking uses can best be grouped into two groups: tax advantages and property protections - infinite banking concept scam. One of the reasons entire life insurance coverage is suitable for Infinite Financial is just how it's tired.

Infinite Banking Vs Bank On Yourself

When you make use of entire life insurance coverage for Infinite Banking, you enter into a personal agreement in between you and your insurance business. These defenses may vary from state to state, they can include security from property searches and seizures, security from judgements and security from financial institutions.

Entire life insurance policy policies are non-correlated assets. This is why they function so well as the economic foundation of Infinite Financial. Regardless of what takes place in the market (stock, actual estate, or otherwise), your insurance plan preserves its well worth.

Market-based investments expand wide range much faster however are revealed to market changes, making them inherently dangerous. What happens if there were a third pail that provided security yet likewise modest, surefire returns? Entire life insurance policy is that 3rd pail. Not only is the rate of return on your entire life insurance policy policy guaranteed, your death advantage and costs are also guaranteed.

This structure straightens completely with the concepts of the Continuous Wide Range Approach. Infinite Banking appeals to those looking for greater economic control. Right here are its main benefits: Liquidity and ease of access: Plan car loans give prompt access to funds without the restrictions of conventional financial institution financings. Tax performance: The money worth grows tax-deferred, and plan finances are tax-free, making it a tax-efficient device for building wide range.

How To Use Whole Life Insurance As A Bank

Asset security: In numerous states, the money worth of life insurance coverage is secured from financial institutions, adding an additional layer of financial protection. While Infinite Banking has its values, it isn't a one-size-fits-all service, and it features substantial downsides. Here's why it may not be the finest technique: Infinite Banking usually needs detailed plan structuring, which can perplex insurance policy holders.

Think of never ever having to stress over financial institution car loans or high rates of interest once more. What if you could borrow money on your terms and construct wealth at the same time? That's the power of limitless banking life insurance coverage. By leveraging the cash money value of entire life insurance policy IUL plans, you can expand your wealth and obtain cash without depending on traditional financial institutions.

There's no set funding term, and you have the freedom to choose the payment timetable, which can be as leisurely as paying off the finance at the time of fatality. This flexibility prolongs to the servicing of the loans, where you can go with interest-only repayments, maintaining the car loan balance flat and workable.

Holding cash in an IUL taken care of account being credited interest can frequently be better than holding the money on deposit at a bank.: You have actually always fantasized of opening your own bakery. You can borrow from your IUL policy to cover the first expenses of leasing a room, purchasing tools, and employing personnel.

Ibc Full Form In Banking

Personal car loans can be obtained from traditional financial institutions and credit history unions. Obtaining money on a debt card is usually very costly with annual portion prices of rate of interest (APR) often getting to 20% to 30% or more a year.

The tax obligation therapy of plan lendings can vary dramatically depending upon your country of residence and the details regards to your IUL plan. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan fundings are usually tax-free, providing a substantial advantage. In other territories, there might be tax obligation ramifications to consider, such as prospective tax obligations on the lending.

Term life insurance only gives a death benefit, without any kind of cash worth buildup. This means there's no cash money value to obtain against.

For finance police officers, the comprehensive laws enforced by the CFPB can be seen as troublesome and restrictive. Loan policemans commonly argue that the CFPB's guidelines produce unneeded red tape, leading to more paperwork and slower car loan handling. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) requirements, while focused on shielding customers, can result in hold-ups in shutting bargains and enhanced functional prices.

Latest Posts

Infinite Financial Systems

Benefits Of Infinite Banking

What Is A Cash Flow Banking System